Modernizing Finance: Is Your Culture Ready for AI?

Every few years exciting new technologies emerge to help organizations boost profits, cut costs and gain market share by utilizing data insights in innovative ways. Finance teams with clear ideas on how to use the tech to achieve strategic business objectives often lead the charge. They sponsor projects, purchase solutions and dedicate resources only to find they are no better for the effort a few years later.

A technology solution is not a guarantee of success

Why do these efforts fail to succeed? For the same reasons that star-studded casts don’t guarantee award winning films, top-shelf ingredients don’t assure successful restaurants and all-star teams fail to win championships.

No matter how brilliant, a technology solution – artificial intelligence or otherwise – cannot guarantee an organization’s success. No amount of cutting-edge technology can replace the necessity of cultural preparedness.

1. Trust is key to AI adoption

There is no question that AI will revolutionize the Office of Finance. Early adopters are using AI for real-time, data-driven predictions and forecasts using a broad set of data points, enhanced risk assessment algorithms and efficient automation of repetitive tasks that reduce the potential for human error.

Despite all the benefits AI promises for finance, leadership teams will need to grapple with the age-old challenge of adoption.

How can organizations ensure cultural readiness for AI? The single most important factor in bringing about adoption is establishing data trust.

Data trust is as much a function of enabling broad data availability as it is ensuring its security and oversight. Management needs to trust who is getting what data while users need confidence in the quality of the data they are using.

2. Reliable, democratized data helps build trust

Democratized data is an important part of building trust. It makes well organized, accurate, relevant data accessible to all members of finance teams. Similar to a band marching to the same beat, democratized data enables everyone to work off the same page.

Democratization of data empowers teams to use data to make informed decisions for their area of responsibility. Democratization encourages a data-driven culture and provides a competitive advantage in financial planning, budgeting, risk management and compliance.

Just as we are more likely to engage a mechanic, construction company or attorney to whom we were referred by a trusted friend, finance teams are more likely to engage AI if the intelligence is derived from reliable, trusted sources.

Organizations that most effectively democratize data prioritize:

- Modern data architectures that enable real-time access to insights

- Data governance and security measures that are tailored for the use case.

For AI solutions, it’s particularly important that the data has been properly vetted (for more on data governance and AI, read our blog). - Comprehensive dashboards and reports

- Self-service analytics platform

3. Automation

AI self-service automation allows for immediate and more efficient data-driven decision making. That in turn leads to meaningful and impactful contributions to an organization’s objectives.

Finance team members must have access to relevant data at their fingertips to:

- Forecast accurately

- Identify growth opportunities

- Optimize costs

- Increase operational efficiency

- Plan strategically

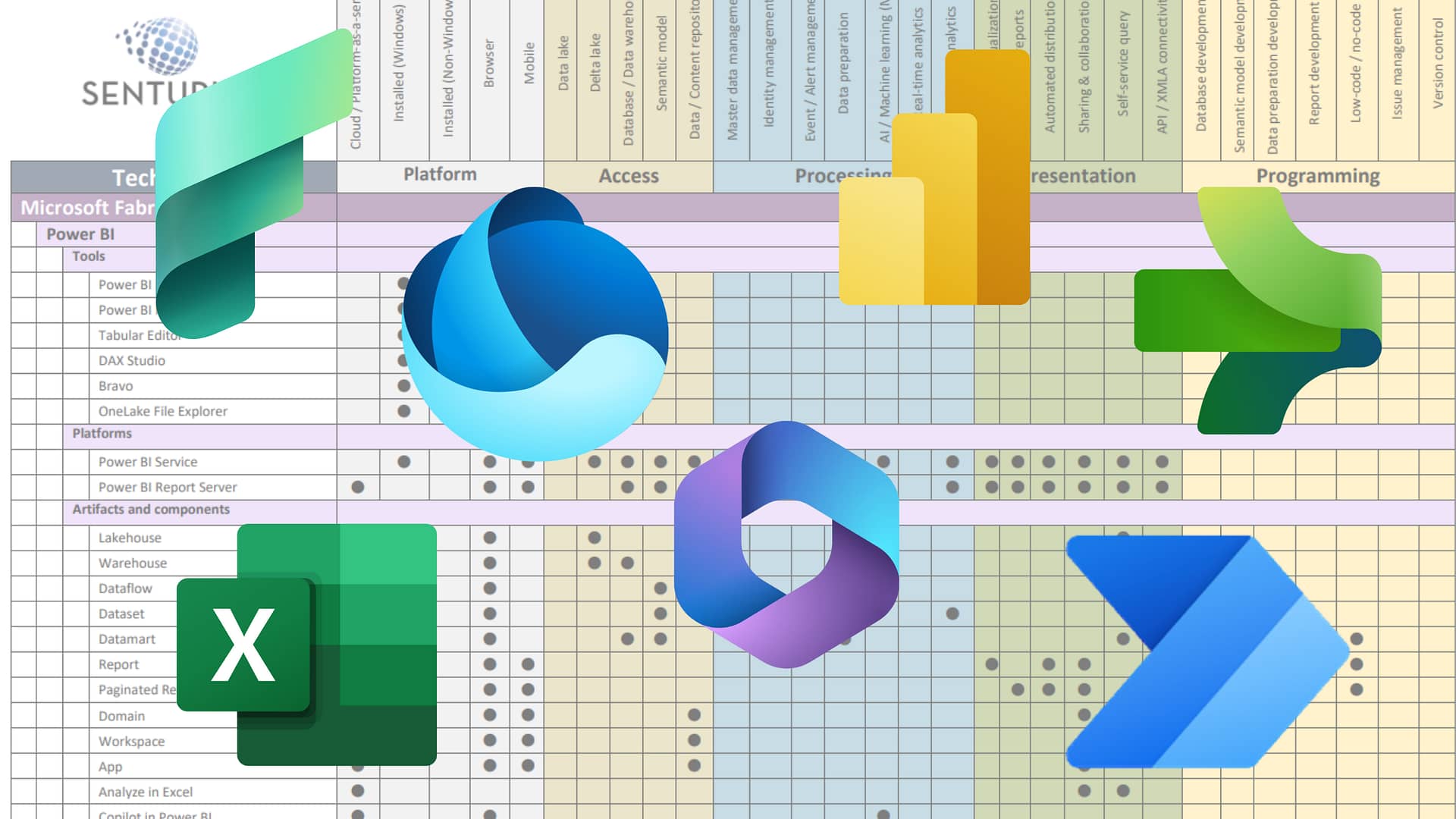

AI and technologies such as Microsoft Fabric aim to accelerate data democratization by streamlining the integration of disparate data sources, in some cases eliminating the need for extensive data warehousing projects.

4. Data governance: Oversight and security

Data governance is critical to establishing the trust necessary to encourage AI engagement. While democratized data empowers all members of finance teams, it amplifies the necessity of a well-designed data oversight and security plan.

When preparing to use AI, you should consider the data as well as the solution itself. Make sure both have been vetted for ethical considerations, bias and privacy. Data governance will be paramount. For more on this subject, read our blog Modernizing Finance: Will Your Data Governance Program Hold Up to AI?

AI can help plan more efficiently, budget, forecast, uncover anomalies and identify opportunities. Finance teams can comfortably engage with a chatbot to help do these things when they can trust that they are accessing secure, accurate, consistent and complete data.

5. The CFO as leader and change agent

CFOs have a pivotal role to play, not just in the technical deployment of AI solutions but also in leading the cultural and skills transformation within their departments. It’s crucial for CFOs to champion a culture of continuous learning and innovation, encouraging their teams to embrace AI tools and the new opportunities they bring.

Enabling this kind of environment involves providing training and development programs to enhance technical and analytical skills. It also means fostering an environment where adaptive thinking and strategic problem-solving are valued.

By supporting the development of new competencies and adjusting to more strategic roles, CFOs can ensure their teams thrive in this new AI era and are positioned to drive the organization forward.

Paving the way for adoption success with AI

Taking steps to ensure adoption is an important consideration when introducing any technology. AI, although still relatively new, is here to stay. It is already providing finance teams with significant benefits through improved accuracy and streamlined operations.

AI automation can clear the way for an evolution in the Office of Finance. By taking over low-value or important but time-consuming tasks, automation can give Finance the space to take on more strategic functionality within the organization.

But as with all technology, simply because AI provides business value, implementation alone is not sufficient to guarantee active use and engagement by end users. In other words, adoption. Cultural preparation for AI requires that all members of an organization have a well-defined vision of the use case, shared values and an established data-driven culture built on trust. Senturus can help you build the foundation for reliable, accessible and well governed data that forms the cornerstone of a data-driven culture. Senturus has over 20 years of experience implementing successful enterprise data and analytics solutions. We take a pragmatic approach to technology, keeping business value top of mind and delivering in phased stages with minimal impact to business.

Whether your AI needs are more strategic and long-term or if you need immediate tactical help such as master data management or data privacy assessment, Senturus can help. Get in touch with one of our experts today.

About the author

September Clementin is a Senior BI Consultant and Trainer with Senturus. She has expert-level experience with multiple BI tools including Power BI, Cognos and Tableau. She has helped 50+ public and private sector clients with large-scale business intelligence implementations including dashboard design, interactive performance metrics development and data modeling. She designs business intelligence course curriculum, delivers 20+ advanced BI reporting courses a year, develops BI best practice webinars and provides mentoring services for other BI professionals.