Understanding your business in the context of unit economics, or the cost to serve a customer, is the holy grail for most companies. Analyzing spend within the context of business demand can help to improve forecasting, assess cost anomalies due to changes in sales volumes, understand the profitability of products and much more.

With the cloud playing such an integral part of business expenditures today, cloud computing costs must be included in the unit economic equation. Obtaining visibility into unit economics is a must-have for business analysis.

In this on-demand webinar, we talk about the challenges of reporting on unit economics and how we solved this challenge for cloud costs using Power BI.

What you’ll get

- A short primer on unit economics.

- A demo of cloud unit economics using Power BI and our proprietary data lakehouse architecture.

- How you can use Power BI’s composite data models to deploy unit economics quickly and securely within your own cloud.

Machine transcript

0:11

Hello everyone.

0:13

Welcome today’s webinar on obtaining unit economics using Power BI.

0:19

Thanks for joining us today and the Next up topics we’re going to cover today.

0:25

So number one, what are unit economics and why are they important, number two we’ll talk about some of the challenges in delivering unit economics.

0:33

It’s not trivial to come up with these values, so we’ll talk a little bit about that.

0:39

We’ll talk about why we like Power BI as an analytics tool for tackling unit economics.

0:46

We’ll do a demo of advisor cloud unit economics, which is a solution we developed specifically around cloud cost optimization.

0:55

And we’ll wrap up, as I said, with some live Q&A.

1:00

Before we head into the bulk of the presentation, we’ll do some quick introductions here.

1:05

Our presenters today are Keith Knowles, who is Managing Director here at Senturus.

1:12

Welcome, Keith.

1:13

Thanks for being here today.

1:17

Second up we’ve got Bob Looney, our VP of Software Engineering.

1:20

Bob will also be handling part of the presentation and running us through some demos today.

1:26

Last but not least, I’m Steve Reed Pittman, Director of Enterprise Architecture and Engineering here at Senturus.

1:32

I’m really just doing kind of the intros and outros and Keith and Bob will be your experts on unit economics for today.

1:40

And before I turn things over to Keith, we’re going to go ahead and run a quick poll now just to get a sense of what level of unit economics maturity you have in your organization today.

1:53

So we got a few options here, like enter your answers anytime.

1:59

So the question is how do you rate your current unit economics maturity?

2:03

Are we just learning what unit economics even means?

2:06

Are you doing occasional manual calculations?

2:10

Are you doing manual calculations on a regular basis, maybe monthly, quarterly, or do you have an automated system that you’re using actively or decision making around unit economics?

2:21

So I’m going to leave this open just for a little bit longer to give everybody time to punch in their answers.

2:29

Well, it’s like a lot of you are just kind of at the beginning of the unit economics journey kind of figuring out what this is and how it might be useful in your organizations.

2:38

It’s like some of you are also doing manual calculations today.

2:41

And right now we’ve got about 20% of you that have an automated solution in place that you’re using.

2:47

So that’s great to hear and hopefully we’ll give you some further ideas today on how to go further down the path of unit economics.

2:58

I’m going to go ahead and end the poll here and share out these results.

3:04

So as I said, a lot of you are just kind of stepping into the waters here.

3:09

It looks like just learning what unit, unit economics are, but again, about professionally you have an automated solution in place it looks like.

3:18

So it would be interesting actually to know if anybody feels like dropping this into the Q&A or the chat, what sort of unit economics implementations you’ve already done.

3:30

So I’m going to go ahead and stop sharing the poll results here.

3:34

And at that I’m going to turn it over to you Keith.

3:38

Thanks, Steve.

3:39

I’m wondering if we should make some of those six that have 20% that are doing unit economics already maybe we make them Co presenters here and have them chime in with some of their best practices.

3:50

What do you think about that?

3:51

That sounds like a great ideal though I think you’ve got a lot of material and not a lot of time.

4:00

So all right.

4:01

Well thank.

4:01

Thank you for the introduction Steve.

4:03

And then that poll that’s really, really great to see folks jumping on the that are already down that path of using unit economics.

4:11

And so we’re going to start off probably more for those that are just learning what they are.

4:16

We’re going to start off with some basics, some of the definitions and then get into the challenges as Steve hinted, right.

4:21

So you know the basics, right?

4:23

What are unit economics and if you look this up, you’re going to find a bunch of slightly different, slightly different definitions of it.

4:32

I think they all kind of come around the same thing, right, that unit economics really start with the value derived from selling a single unit, right.

4:39

It’s expressed in terms of marginal revenue and marginal cost and ultimately you’re able to derive marginal profit per unit sold.

4:48

Now this is typically expressed in terms of either an item, so or an item sold or customer and I’ll talk a little bit more about that in a moment, but I have cost highlighted here for the specific reason.

5:01

The bulk of what we’re talking about today is going to be on the cost side.

5:03

So we’re going to be talking about how you get to the cost side of that equation.

5:08

We’re not really focusing on the marginal revenue side.

5:10

Most companies actually do a great job of tracking that.

5:13

But it’s the costs that that are typically a lot of companies.

5:18

It’s a big number that doesn’t have a lot of granularity to it.

5:23

And for those of you out of the BI world, we’re all about granularity.

5:25

So we’ll get more into that in a moment.

5:27

But when you start looking at specifically how do you, how do you measure that in some of the different examples, right.

5:32

So when you look at the types of businesses, how do you, what are you looking at?

5:36

What are you measuring?

5:38

These are some simple examples just to provoke some thought here, right.

5:42

But Uber typically is going to be a ride is what they’re going to be looking at Netflix, a customer subscription insurance companies may have, you know companies may have multiple things that they’re measuring a policy and an insurance company customer claim and the cost typically when you’re talking about unit economics, obviously claim side and the insurance companies can be very well managed and understood.

6:02

It comes down to the cost of service.

6:04

That claim is where you start really getting some interesting numbers from a unit economics perspective, airlines, seats sold for bag, SaaS customer seat.

6:13

Now that’s a pretty high level when you start thinking about it and talking about Netflix for a moment, you start thinking about a customer subscription.

6:21

Well, what really goes into that when you start thinking about the breaking down the cost a little bit and you typically what happens, there’s an activity on Netflix, it’s watching, watching you know a movie or show.

6:34

And so they’re going to have you looking at it from that perspective.

6:37

Then ultimately there’s going to be a lot of assumptions that go into get that to the customer level, a lot of a lot of assumptions probably based on some pretty fine grained demographics as far as their users and what the average number of shows that that user may look at.

6:52

So it can get pretty complicated, right.

6:54

But you know, if you, if you think about it from a perspective of how do I want to go about this calculation, there’s another level to this and that is how you define it and ultimately where you’re going to go and look for these costs.

7:09

So two methods typically come up.

7:13

One is looking at it from a customer perspective.

7:16

Again, back to that, that Netflix example, typically they’re going to be looking at it from a customer perspective.

7:21

And there’s a whole lot of assumptions that typically go into the customer perspective.

7:25

If you start looking at the lifetime value and then the cost to acquire that that customer and then obviously there’s the cost to service that customer, which equates back to lifetime value.

7:36

For those of you that have looked at a lifetime value calculation, thought about calculating, it’s a really complex, really complex calculation with a lot of assumptions into it.

7:45

How long is a customer going to stay with me?

7:48

How much are they going to spend over the lifetime?

7:50

And then you know, back to the assumptions into the activities during that lifetime, not to mention the cost to acquire that customer.

7:57

So for the most part, we’re going to be focusing on the second method here.

8:01

So the unit equals one item sold, so marginal profit generated when a company sells a single unit of well sells a unit, single unit.

8:11

So contribution is going to equal a selling price minus variable unit cost.

8:15

We’re focused on those unit costs for this the restless conversation.

8:20

Now I will say if you are happen to be a start up which I don’t believe we have any on this on this call, but a start up going after VC funding you’re going to be looking at unit 1.

8:29

So you’re going to have to come up with a lot of assumptions to do a lot of data analysis to predict that lifetime value of a customer.

8:35

If you’re a bigger cost, bigger company, which the bulk of the folks here attending today are, they’re going to be looking at more or less trying to break things down into the unit cost to serve.

8:46

We’ll talk more about this.

8:47

It all sounds really simple though, right?

8:50

Simple if you have a lemonade stand, right.

8:52

So it doesn’t get much simpler than this, right?

8:55

Selling cost of $2.00 per cup of lemonade.

8:57

Inflation’s hit that pretty hard in the last couple years.

9:00

Lemonade mix contribution, you borrowed cups from your parents.

9:04

So it’s very simple when you start looking at it at a lemonade stand or business.

9:08

But the reality is for I think everybody on this call, it’s not that simple, right?

9:13

You have employees, multiple businesses, you have multiple products, multiple sales channels, you have different types of IT costs, different types of selling costs.

9:21

It gets pretty complicated pretty fast.

9:23

And this, this income statement that I have here is actually a really simple view into an income statement, right.

9:29

So typically you know if you talk to and we have some Fortune 100 customers on here today, the line items that go into this, there’s a lot more to it, right.

9:38

And you start looking at how do I break this thing down.

9:41

And so we talk about how do you, how do you approach unit economics and how do you get to it.

9:49

Keep in mind, I go back to we’re focusing primarily on the cost of this conversation.

9:53

So you want to start thinking about breaking this down.

9:56

We talked about cost to serve or building blocks, your unit economics.

9:59

So breaking down your cost into logical chunks, logical building blocks, focusing in on typically highly variable costs that are that are both material and that you have some control over.

10:11

It doesn’t take a lot of time or doesn’t make, doesn’t make a lot of sense to focus on costs that can’t be controlled that they’re just that they are what they are.

10:20

So we focus on highly variable costs such as marketing, sales, customer service, IT, et cetera, those types of things and then functional areas.

10:29

Now the example I have on here which I think is, is really interesting.

10:34

If you look at it over a period of about 10 or 15 years, that’s the cost to acquire a customer and the marketing and sales organization, there’s been so much investment into the technology in those areas that most companies that have a mature selling model really understand what it costs to acquire customer.

10:52

Now don’t focus too much on the numbers on here, but if you but the concepts right because if you look at like technology software, if you’re if you’re B to C software provider, your cost may be down into you know $10 per customer.

11:05

If you’re B, you know B to C, I’m sorry B to B and potentially even a large enterprise, your costs are going to be substantially higher than 395.

11:14

But more of the messages here is twofold.

11:16

One is some parts of this when you break it down to functional area the costs are pretty, pretty valuable from helping you predict your future costs and understanding your selling cost.

11:28

They also help you benchmark things so you know different areas.

11:32

You can start benchmarking functional areas by understanding these costs and then ultimately if you have a road map to build these costs back up you can get to that variable cost that that unit economics for your overall product.

11:47

So it’s pretty interesting when you start looking at it.

11:49

But again areas different areas have different levels of maturity.

11:53

We’re going to use a cloud cost example a little later in this presentation.

11:57

The cloud costs are kind of emerging and really starting to mature but you find areas again marketing sales highly mature IT starting to really make some inroads in this usually people that you know COGS, traditional COGS as far as if I’m selling a product it’s pretty well understood what those costs are.

12:14

Finance, insurance industries typically really understand what a lot of their costs are and just building this out makes just makes it better.

12:22

So OK so value of unit economics what do we what do we do with these I’ve alluded to some of these things right.

12:28

So help you do better pricing, help you understand your cost better, help you improve your forecasting.

12:34

And then the benchmarking, I’ve got an example, I understand your cost split better.

12:38

But you know if you think about pricing, if you don’t understand the marginal cost to serve, you can’t really price effectively understanding costs.

12:47

If you, if you’re looking at cost just at a point in time and looking at it without context of business value and what your business activity is, you may not really fully understand those costs.

12:58

And when you look at improving your forecasting, this has been a movement over the last 20 years, right?

13:04

It’s driver based forecasting.

13:05

How do I get to the most granular level that’s relevant for making the forecast?

13:10

So if I understand my costs at a granular level, my cost to serve, I can do a better job forecasting as opposed to saying that the old way was let’s forecast 10% increase in our business that’s that really isn’t helpful.

13:24

When you break that down and start slicing across different products, you may have a company with multiple product lines, Product A is going to grow, you expect it to grow by 100% next year.

13:34

Product B maybe isn’t a decline but if you if you don’t look at it at a granular level at the driver level, forecasting’s not going to be very accurate.

13:43

And so unit economics is super valuable in there.

13:46

And then benchmarking, we’re constantly asked from folks when we’re engaging on the sales and pre sales and it’s and then clients are always asking how am I doing and benchmarking unit economics is a great way to sell to better understand the health of your business.

14:05

A lot of different industry associations that collect that data usually it’s anonymous and you can you can start to understand that how you stack up certain industries treated like it’s the trade secrets and you’re not going to be able to get it but at least it’s something that you can set targets against to improve over time.

14:23

Now back to the unit understanding cost, right.

14:25

So I’m using a Black Friday example cost spike this, this happens to be daily cloud spend.

14:30

This could be labor for a retail customer it could be almost anything.

14:34

But I’m picking on and leveraging cloud spend cause again our example later is going to be on cloud spend.

14:40

So is this a problem right.

14:41

So Black Friday through Cyber Monday, I see my cloud costs almost quadruple in this case, right.

14:47

So I’m my run rates a little over 5000 a day for cloud spend and then it spikes on these things.

14:53

Is that a problem?

14:54

Some people, if they don’t really have context of the business volume will say yes, that’s a problem.

14:59

But if you look at it from a unit economics perspective, so, so you’re looking at it from a perspective of what are my unit economics in this case, just take a rough number, call it $0.32 per activity.

15:14

From a cloud cost perspective, I don’t have a problem here, it’s a non issue.

15:19

So when I’m looking at that same cost data in context of unit economics, Cyber Monday actually is well in line.

15:28

The whole weekend is in line with my regular cloud cost.

15:31

So having the access to this data in a near real time fashion really helps you better understand how your, the health of your business and how various aspects of that are performing.

15:43

Let me just talk a little bit about challenges here and Bob you’re going to jump in here a little bit and yeah, I’ll, I’ll take the challenges for go forward here for a second.

15:56

So let’s first talk about security.

15:59

Obviously it gets very technical, but at you know, at the high level where is your data going to live is a very key point because a lot of this is sales data or very sensitive company data that maybe you have policies around allowing like a third party SaaS tool to pick something like that up and use that tooling.

16:20

You need audit logs, audit trails on that sort of data, who’s seen it, who has access to it, you they need to maintain processes around approvals of who gets access to certain data.

16:34

So all your typical security challenges that you wind up with over time, the next thing that you have is different data sources.

16:44

You have databases, you have files, you might have SaaS tools that you’re looking to import data from.

16:51

You need to gather, clean, and model all this data together, and then you need to find common dimensionality between different data sources so that you can tie things like cloud, cost or other items together and mesh that data in a way that you can view valuable metrics from that combined data set.

17:11

A third challenge is bespoke calculations.

17:14

Everyone’s organization runs on different KPIs.

17:18

You’re doing business slightly differently than the than the next organization.

17:23

You have differentiators.

17:25

If you were looking to filter out in certain aspects of your data or focus on key concepts in your organization that set you apart, that uniqueness tends to make out-of-the-box solutions unhelpful.

17:40

So people wind up doing things like exporting data to Excel and doing Excel calculations and now you’re back into security type issues.

17:51

And lastly we’ll talk about availability and recency being a challenge.

17:58

If you do a one time exercise, you know back of the napkin math, both accuracy might suffer, but you also have invested a lot of time to do this one off calculation.

18:12

And then maybe you have another question about the data that comes up and you would have to slice that data in a different way because what you calculated was a summary and now you want to see it by a product line or something like that.

18:25

And so now you’re redoing that manual calculation again investing all sorts of time.

18:30

So those are some of the common challenges we see and hear about with unit economics.

18:36

I’ll just add a little color to that, right.

18:38

So we deal with a number of Fortune 500 financial services companies and whenever this comes up today we want to you know I want to get into unit economics.

18:48

The first things that always come up are #1 and #3 right is the security of this.

18:52

There are some tools out there for that will handle very simple SaaS type calculations if based on like units shipped or volumes.

19:02

And invariably these folks start saying you know what, we will not let this data out of our control.

19:08

So they end up wanting to have a solution built within domain.

19:13

So built, you know, sometimes they would use the term on Prem whether that’s within their cloud or within their own data center.

19:18

But they just will not let that, that sales data out of their control for the reasons Bob said and I’ll add 1 to it as well.

19:25

There’s a lot of these companies, I mean, I shouldn’t say a lot of them, they’re all public companies and this type of data if gotten into the wrong hands can move markets.

19:33

So it’s really important for folks to think about these, the security and where that data lives.

19:37

And with that said, I’ll move on to the next slide.

19:40

Sure.

19:43

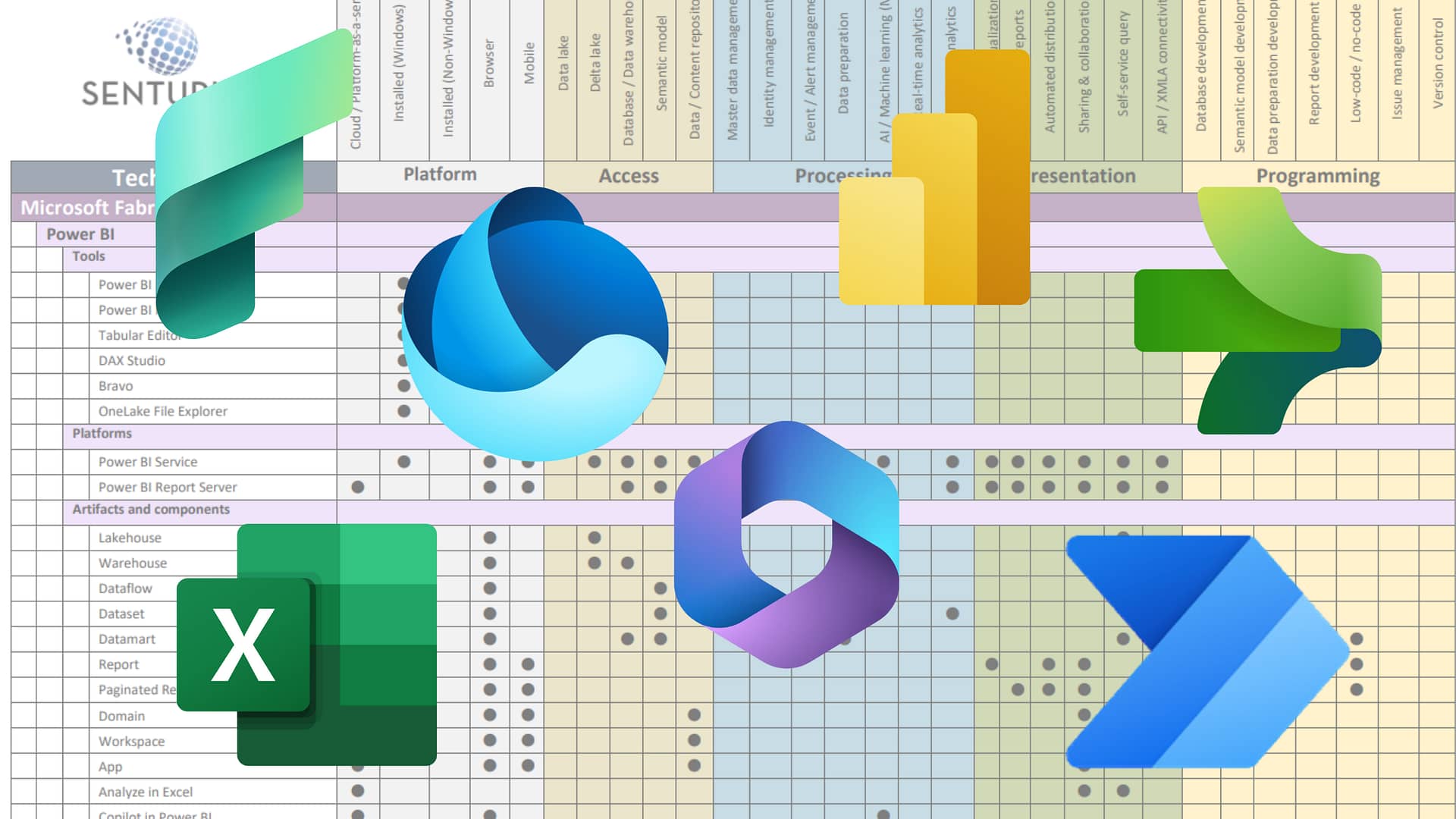

And we’re going to talk about just Power BI for a second.

19:46

It’s the tool we’re going to highlight today.

19:48

Obviously, there are other BI tools that Senturus supports as well.

19:54

But Power BI, there’s a lot of power here for unit economics and some of the challenges we just talked about.

20:01

So the first is composite models of being able to pull in multiple data sources back into.

20:09

Into a combined model that you can then create calculations in that data model of data coming from different data sources to give you some really unique metrics.

20:22

Next security related is real level security.

20:26

This is the idea of slicing data so that departments could only see their data or business units could only see their business unit, Things like that, as well as access to the workspaces and the audit trails that comes built in with the Power BI in the Microsoft suite you get flexible deployment options both from an on Prem and hosted service scenario, mobile app delivery, all sorts of things like that.

20:54

And lastly, there’s a fantastic feature called Analyze in Excel where you can connect to those data models, either single or combined data models and pull that directly into Excel and then later refresh that data set from that data model so that again security is being maintained, you only have access to what you should be having access to.

21:16

Audit trails are in place and the like.

21:21

This is we’re transitioning here at the composite model gives you a lot of flexibility to talk about the, the flexible deployment aspect of things.

21:28

Being able to pull data in from a third party source potentially.

21:32

Let’s just say a client was using Salesforce and you want to pull data from that into a composite model provides a lot of flexibility to maintain the data within your environment as well as pulling it from outside sources, absolutely.

21:47

So let’s talk about our example and in the demo we’re going to going to show here in a bit.

21:53

So as you mentioned, we, we are talking specifically about cloud cost today, but I want to emphasize these same principles are universal for any sort of unit economic building blocks.

22:05

So all the metrics that as you mentioned Netflix might be using to track their folks, the same sorts of concepts still apply.

22:15

But what we’re going to show is our advisor product, which is all about pulling cost and usage information from different cloud providers and cleaning that and normalizing that and modeling that data and how we can combine that with information from client data sources to produce some really interesting metrics.

22:36

At the end of the day, I’m going to just do a quick, give a little quick preview on what Bob’s going to show.

22:46

So let’s kind of set that up.

22:47

So new case studies is actually a client of ours and I’m not going to name the client, but this is actually a client environment that we have permission to share on here.

22:56

Some of the things have been mocked up.

22:57

So you don’t see the exact same numbers but the concepts are all accurate and but basically the environment we walked into was a manual in calculation of unit economics.

23:08

They had last done it 18 months prior.

23:10

So it it’s a pretty honorous thing to go and do unit economics.

23:15

There’s no dimensionality in the data when they calculated it manually.

23:17

So by dimensionality we talk about the concepts of whether it’s you know by the hour, different types of slices that may come into that whether it’s fixed versus variable.

23:27

So it’s pretty well it helps in pricing but it doesn’t necessarily help if you have a customer that may come in with some unique needs and you want to understand, understand if they need could give a better deal or special pricing on that.

23:41

So pretty interesting when you then contrast that.

23:43

So once we did this implemented the model that Bob’s going to share with the moment the data is updated daily, the dimensionality is there.

23:51

So they have hourly data, hourly granularity and a whole lot more than Bob will show you.

23:57

They have time analysis that they can do.

23:58

So look at the time of day, what basically what the costs were at the time of day and this is an e-mail vendor.

24:05

So you when you see this probably talking about some of the different aspects of emails out returns, clicks, opens, those types of things.

24:14

So time analysis uncovered some pretty interesting things and I’m not going to share too much more and I’ll, I’ll let Bob take over here and get to the demo itself.

24:23

So, so let’s start by talking about, yeah, the, the client as you mentioned, they send out marketing emails.

24:31

They host websites where those emails send people and they track the opens, they track clicks back to that website.

24:41

They track obviously their cost of sending out emails.

24:46

All those things are very interesting to them as they market and sell their product.

24:51

So first let’s talk about different data sources.

24:53

So this is one of the challenges we talked about earlier that Power BI and that can help address.

24:59

So one of our data sources here is in Visor which is where we’re getting all the cloud spend, cloud cost information.

25:07

And then the end the other data source we’re using on this were server logs for e-mail and web activity that the client was able to provide.

25:15

And so you can, were able to combine those in a Power BI model and come up with some common dimensionality things like what environment were the cloud resources assigned to or what environment was producing the activity metrics as well as obviously date and time.

25:39

The other thing to start talking about is some calculations.

25:43

So this client is slightly unique that are not just a technology company there they have a very specific niche of their market.

25:52

And so a couple things to highlight.

25:54

They think of their business as far as outbound versus inbound.

25:58

So they have outbound you see here in the top left concepts is around how many emails are sent, what was their cost of outbound things like that.

26:11

Then they have inbound, these are how many people clicked on emails, how many people open emails.

26:15

It causes a web server load in their environment which has associated cost with that.

26:21

So they’re able to track both the activity and the cost of those two aspects of their system.

26:27

Another thing to look at is fixed cost versus variable cost.

26:32

Fixed cost being things that are that are fairly keep the lights on servers that you can’t turn off services that have to be running all the time.

26:41

They’re not affected by demand or in general and not easily affected by demand versus the cost you’ll see highlighted in the top two are both variable costs.

26:53

So the number of emails being sent, the number of inbound activity happening can directly and in very short term affect the cost of those two aspects of the system.

27:08

And then lastly, we have all sorts of filtering as far as environments, state ranges, cloud services.

27:18

So you can filter down to understand which cloud services are affecting which costs, where you can investigate things like your peaks and valleys to understand what was happening on specific days.

27:32

Obviously this was like a weekend day so they didn’t send as many emails and so as a result their cost for sending emails was much higher versus a day where they sent many emails.

27:45

As the volume goes up, the cost goes down.

27:47

This is often the case.

27:51

Keith also spoke to recent sees that we can pull those data feeds and create systems and processes to update this daily or even hourly if desired.

28:01

And then behind the scenes security in the Power BI workspace with governed access row level security would even be possible if you wanted to take this environment and isolate it to specific users.

28:18

And then auto logging is handled by Microsoft in the background as well.

28:27

Keith I think that’s back to you.

28:29

Thanks Bob.

28:30

It’s you know when you look at this it’s pretty interesting too.

28:34

I’m going to just point out on the hourly analysis right you need to be careful on some of this data.

28:38

When you start looking at your assumption is that some of these time frames would be really expensive to send an e-mail.

28:45

But the reality is it’s because the fixed costs are not being spread out.

28:48

So you do always have to be, just make sure that you’re designing these reports for your audience.

28:53

The beauty of Power BI is it’s very easy to change these things.

28:57

And for those of you that are using Power BI, you’re I’m sure, very familiar with that.

29:02

All right, I am going to grab the screen back.

29:06

All right.

29:06

So some of Keith’s takeaways, right.

29:08

So, so as we talked about this, trying to do unit economics is, is a bit like the proverbial story of how do you eat an elephant, right.

29:16

So it’s kind of one step at a time or one bite at a time.

29:19

We really talk about focusing on a value, right?

29:22

So prioritize material value, variable cost that you can control.

29:27

So I did mention this earlier, right.

29:29

So if you have some costs that just are for the most part near impossible to change, doesn’t make a whole lot of sense to spend time trying to better understand those.

29:39

So focus on those costs that that are variable that you can control.

29:43

So we also recommend that it if you’re going down this path of how we’re going to break this thing up and have these building blocks right, there’s the cost to serve at various types of various parts of the organization develop a road map for delivering those building blocks that are offering incremental value.

29:59

So think about how you wanted to deliver that and have that road map so that you’re building towards a story and flexibility is king.

30:06

So Bob talked a little bit about the design that we have.

30:10

We do find Power BI is like an excellent way to build this out.

30:13

The analyzing Excel aspect of Power BI gives you some excellent ways to prototype, to build stuff out before you actually go back and build out a data warehouse solution, composite model, etcetera.

30:26

So there’s a lot of flexibility and power given by using the Power BI.

30:29

But think about an architecture that’s going to be flexible.

30:32

One of the things that we know in this world right is the change is constant, right.

30:37

So you always need to be thinking about making sure that your, your environment is flexible enough to handle the future.

30:44

Then design with security in mind.

30:45

Again, UE data unit economics, data is almost always closely guarded.

30:50

It does in some cases it’s, it’s an SEC requirement.

30:55

If that data gets out, you can change your stock price.

30:57

So you need to make sure you’re designing with that security in mind.

31:00

And with that said, I’m going to turn the floor back over to Steve and we’re going to let him call it wrap up.

31:09

All right.

31:09

Thank you, Keith.

31:12

So quick just next steps.

31:14

If you’re interested in the cloud cost management specific stuff that we did in our demo, you can check out www.advisor.io, find out all about the advisor tool set over there.

31:28

But also if you’re just looking for, you know, questions about how to tackle unit economics in your organization, kind of how to tackle the analytics and the data side of that, which of course can be very complex, but we’d be happy to talk to you about that.

31:41

You can reach out to us at [email protected] with any questions you have about tackling unit economics.

31:51

Beyond that, we do have a couple of upcoming events just want to make everybody aware of as well as additional resources.

31:58

You can find our website.

32:00

We’ve got webinar coming up on March 14th on Microsoft Fabric premium capacities which also applies to Power BI premium capacities.

32:09

We’re going to talk a little bit about avoiding pitfalls with Premium and how to maximize performance.

32:16

On March 20th, we have Q and A on Microsoft, excuse me, Copilot for Power BI.

32:23

If you know much about the Copilot sort of sphere within Microsoft, there are actually a few different copilots this webinar.

32:33

On March 20th, the Q&A will be specifically about the Copilot features that are inside Power BI, so join us for that.

32:41

We also have on demand recordings of a former webinar which was using live data from Power BI within the Microsoft 365 suite, and there’s a bunch more also to be found in our Knowledge Center.

32:56

Visit senturus.com/resources.

32:58

You’ll find blogs, you’ll find past webinars, tips and tricks, a wealth of resources available 24/7.

33:06

So check that out.

33:07

Senturus.com/resources.

33:12

Quick little bit just about us if you don’t already know.

33:15

So Senturus, we here at Senturus, we provide a full spectrum of that services as well as some proprietary software solutions to accelerate bimodal BI and migrations.

33:27

And we have a wealth of experience in hybrid BI environments.

33:32

We’ve been around for a lot of years and have seen a lot and done a lot, a long strong history of success, 23 years in business 1400 plus clients over 3000 projects.

33:44

You might see some familiar logos there on your screen.

33:49

We’re really dedicated to helping customers in their analytics journeys.

33:54

We have spent all of these years really operating at the intersection of IT and the business, which is exactly what unit economics brings you up against.

34:05

So don’t hesitate to reach out to us if you need any help.

34:10

And with that we’re on to the Q&A section.

34:13

The Q&A panel has actually been pretty quiet, but there is one question so I wanted to put out there, which is when you’re tackling unit economics, Keith and Bob, what is the like who, who are the OR who are the players that you need within your organization to be involved in this?

34:31

I think this is a classic case of the that kind of intersection of IT in the business.

34:36

But like who are the, who are the people who need to be involved in the unit economics initiative?

34:45

Yeah.

34:45

So, so that’s the old, it depends, right the different areas of the company may in different functional areas will typically involve different folks.

34:55

And so one of the example I used earlier, customer acquisition costs from a marketing and sales perspective, a lot of times marketing sales are producing those numbers today and they’re able to do it because they have pretty standardized and relatively mature platforms that they’re leveraging to calculate that out.

35:13

Now that may come in.

35:15

So at a system level as an example perhaps we’re getting the customer acquisition cost at a fairly granular level, the market automation tooling, the CRM system except it you know across the board and they have to aggregate it which then might require somebody from BI, Folk, BI discipline to kind of pull that together and ultimately calculate it out.

35:38

You start getting into more of the cloud economics and unit economics in the cloud.

35:43

A lot of times that’s going to be folks that are either you know responsible for cloud cost optimization, but they should be doing it in context with the business.

35:52

So ultimately a combination of folks that are in that IT and then the business stakeholders that are responsible for that specific functional area.

36:02

All right, well with that, I think we’re going to go ahead and wrap up.

36:05

Unless anybody has last minute questions, you can type them into the Q&A panel.

36:09

I’ll leave that open here for just a little bit just in case there are any last questions, but if not, we will go ahead and wrap up.

36:20

So thank you everybody for attending today’s presentation.

36:25

By all means reach out to us with any questions you have about tackling unit economics.

36:30

You can reach us by phone, you can reach us by e-mail, you can reach us on the web, whatever, you can reach us on LinkedIn.

36:37

Look at that.

36:37

I don’t want to miss any of the items here on our slide, so don’t hesitate to reach out.

36:43

We’d love to talk to you about your own unit economics journey and help you in any way we can with going down this path and getting better cost data for your organization to help maximize profit ultimately because that’s what business is ultimately about.

36:59

So thank you again everybody for joining us today.

37:02

We hope to see you again on a future Senturus webinar.

37:07

Have a great day everybody.

37:08

Thank you.